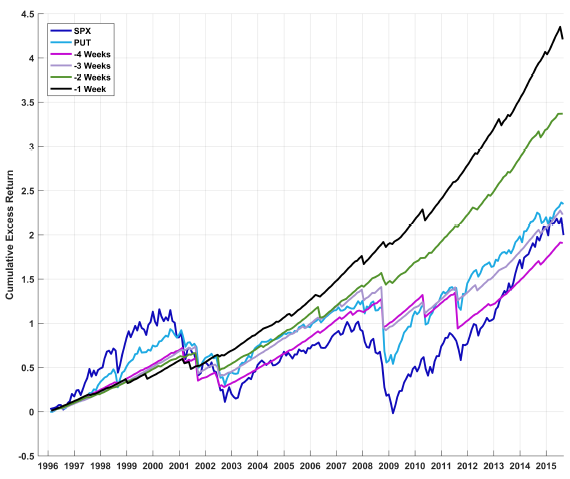

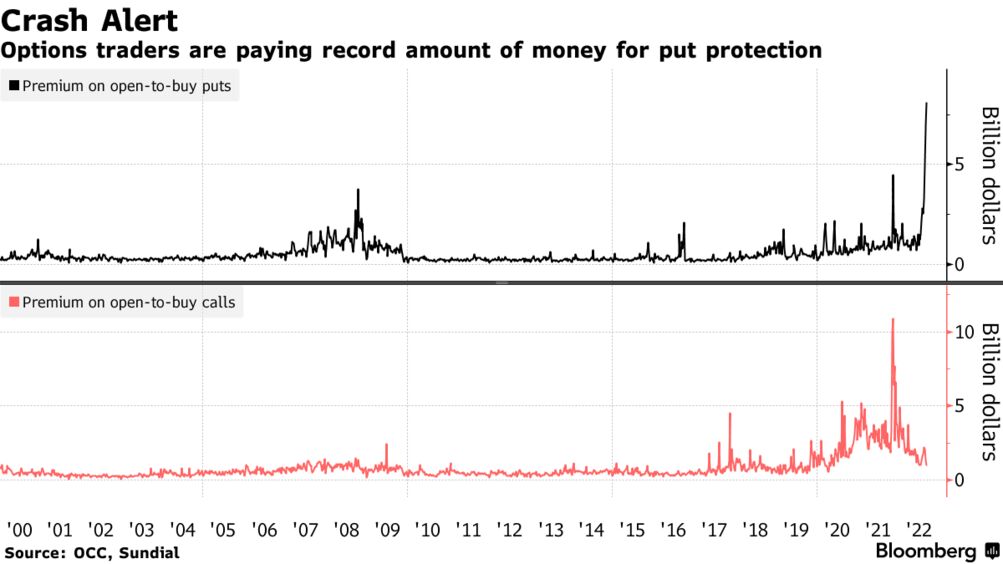

Net Put Premium And Options Expiration Week Suggest A Huge Rally Ahead | Don't Ignore This Chart! | StockCharts.com

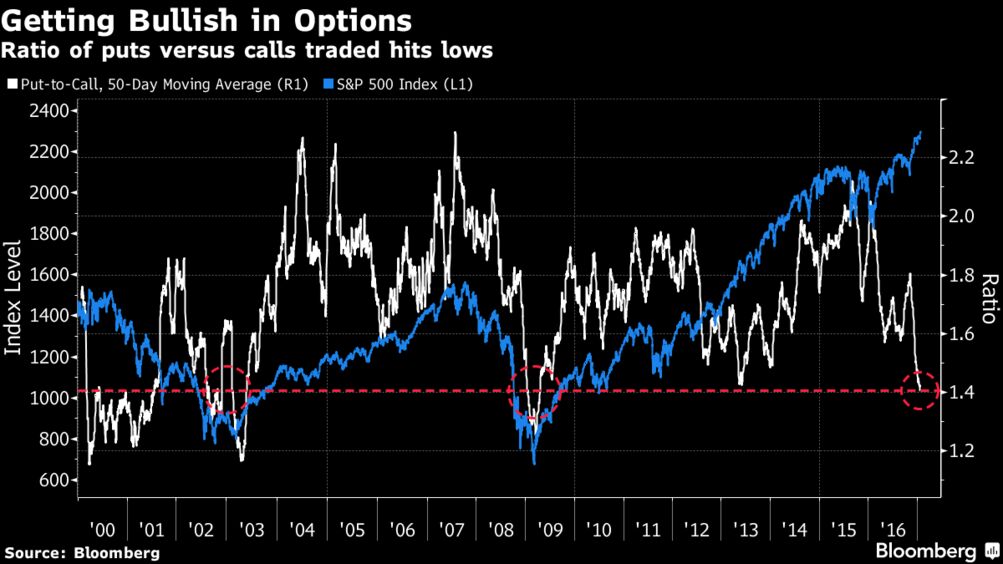

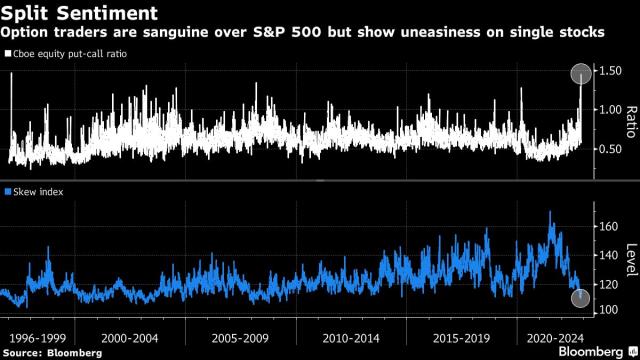

Jesse Felder on Twitter: "'Total open interest in put options on the S&P 500 index is around a four-year low.' https://t.co/BPYNiJ58oj https://t.co/zK6U6CwoEG" / Twitter

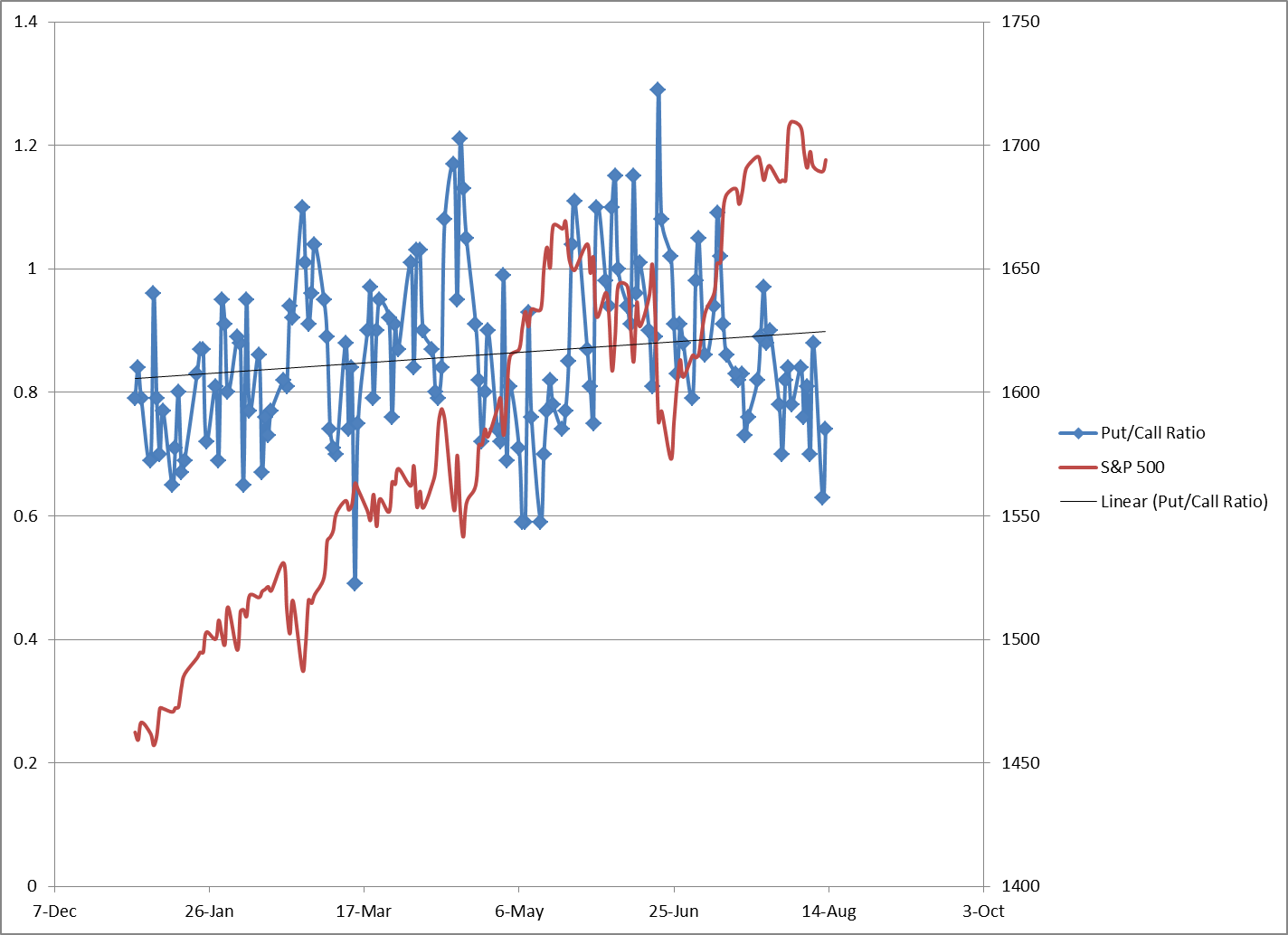

![Put/Call Ratio [ChartSchool] Put/Call Ratio [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=market_indicators:put_call_ratio:pcr-7-cpcsmooth.png)

![PDF] Pricing S&P 500 Index Put Options: Smiles, Skews, and Leverage | Semantic Scholar PDF] Pricing S&P 500 Index Put Options: Smiles, Skews, and Leverage | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/caba57d2a6847a22c214851dea1f09e1ebb016e5/27-Table1-1.png)